Exploring Festive Season Investment Opportunities

Hello everyone, with the festive season in India just around the corner, lasting from September to December, it’s the perfect time to explore investment opportunities. Historically, during this period, markets tend to rally not only in India but also in the US, known as the Santa Claus rally. Many of you have been asking for investment ideas centered around this festive period, like buying gold or investing in companies like Titan. However, investing based solely on this notion is amateurish. To make informed investment decisions, it’s crucial to consider fundamentals, technicals, and macroeconomics behind festive season stocks.

Investment Insights

Today, I’ll discuss some promising festive season stocks that are well-positioned for potential gains.

Home Decor and Paint Stocks

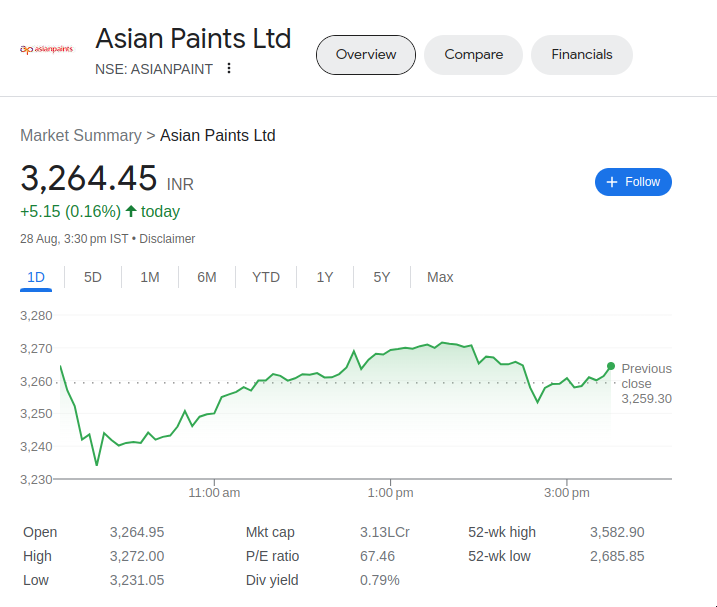

First up, consider home decor and paint stocks. During festivals, there’s typically a surge in demand for painting homes and decorating spaces. Asian Paints, a prominent player, has exhibited a start-stop pattern historically, suggesting potential for a rally. Keep in mind that this rally might not align precisely with Diwali, as operators can manipulate stock prices based on sentiment. Indigo Paints and Jyoti Resins are also intriguing options, catering to different market segments.

Real Estate Stocks

Real estate stocks are another area to consider. With predictions of interest rate cuts, demand for housing could increase, benefiting real estate companies.If you prefer real estate stocks, companies like Godrej Properties and Bandhan Bank could be worth exploring.

Banking Stocks

Interest rate cuts can also impact banking stocks positively. Large-cap banks like HDFC, ICICI, and Kotak Mahindra have seen subdued performance despite strong fundamentals. Public sector banks like Punjab National Bank have shown significant rallies. Additionally, small finance banks like Equitas and Ujjivan have performed well, and Bandhan Bank’s expansion into rural areas could offer growth potential.

E-commerce and Luxury Segment

E-commerce and luxury segment stocks have also shown promise. Amazon, despite its significant run-up, remains undervalued. Its diverse revenue streams, including retail, cloud, and AI, position it well for future growth. In the Indian market, Vedant Fashion (Mannequin) showcases a unique approach to direct-to-consumer fashion, targeting various price points.

Closing Thoughts

In conclusion, while the festive season can present investment opportunities, it’s essential to base your decisions on sound analysis rather than jumping on popular trends. Be mindful of undervalued opportunities, and remember that short-term gains might not always be sustainable. Consider the potential of the companies, their fundamentals, and the broader market scenario. Always maintain a diversified portfolio and stay updated with the latest trends and insights.

Also Read:

7 DIVIDEND STOCKS TO BUY FOR INCOME IN 2023

RVNL STOCK SURGES ALMOST 4%